Reference data is used extensively by insurers for a variety of purposes. Reference data is a type of data that is used as a reference point for other data. It can be used to compare and contrast other data, or to verify the accuracy of other data. In this article, we’ll discuss how insurers use and analyze reference data. Keep reading to learn more about insurers and reference data.

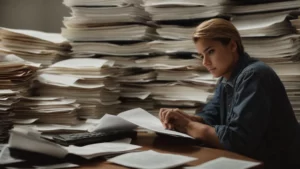

How Insurers Analyze Reference Data

Before we dive into the various ways that insurers use reference data, let’s look at how they analyze it first. Insurers typically use a reference data management solution to analyze reference data. Reference data includes information about customers, agents, policies, and claims.

Reference data management solutions help insurers consolidate data from multiple sources, clean up and standardize data, and analyze data for trends and patterns. It also helps them make better decisions about pricing, underwriting, and risk management.

Reference data management solutions use sophisticated algorithms and data-mining techniques to analyze the data. This analysis can reveal trends and patterns that can help insurers in various ways.

Identify and Authenticate Customers

Insurance companies that have strong financial ratings and prominent reputations, like American General Life Insurance, use reference data to improve their operations in several ways. One of the most important is to identify and authenticate customers. This helps prevent fraud and ensures that customers can only access their own information.

Reference data is essential for insurers to identify and authenticate customers. By cross-referencing customer data against trusted data sources, insurers can be sure that they are dealing with legitimate customers. This is especially important for insurers that offer online or mobile services, as they need to be sure that their customers are who they say they are in order to protect against fraud.

Reference data can also be used to assess customer risk. By identifying customers who are likely to be high-risk, insurers can take steps to reduce their risk exposure. This may include increased fraud monitoring or higher premiums for high-risk customers. This data is also used to determine eligibility for insurance products. By matching customer data against pre-determined criteria, insurers can determine whether a customer is eligible for a particular product. This helps to ensure that customers are only offered products that are appropriate for them, and that they are not over or under-insured.

Overall, reference data management is a key part of the customer identification and authentication process. By using trusted data sources, insurers can be sure that they are dealing with legitimate customers and can take steps to reduce their risk exposure.

To Price Policies

The use of reference data in pricing allows insurers to not only price policies accurately, but also to price them relatively quickly. Additionally, it can help ensure that premiums are fair and equitable for all policyholders.

There are a few different ways that this data can be used in pricing insurance policies. The most common way is to use the data to develop actuarial models. Actuaries use actuarial models to help them determine how much money an insurance company should set aside to pay future claims. The models use various data, including claim information and loss history.

This data can also be used to price policies in real-time. This is done by using data to develop pricing algorithms that are used to set premiums for each policy. This real-time pricing can help ensure that premiums are as accurate as possible. In addition, it can help ensure that the price of a policy is reflective of the risk that is associated with the policy.

Utilizing Reference Data

Insurers use and analyze reference data in several ways to improve their operations, security, and customer experience. Most insurers use reference data management solutions to analyze the data. They then use this data to identify and authenticate customers, determine eligibility, and even price policies accordingly.