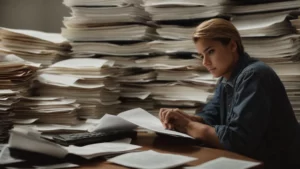

Investing in this new year involves many decisions and analysis techniques. Over the last two years, investors have seen a significant level of uncertainty that simply hasn’t existed in the marketplace in a long time. While there will always be hiccups and bear market price action to handle, the coronavirus pandemic has left everyone bruised and battered both mentally and financially.

Yet, there remains a vibrant landscape of investment opportunities out there for traders to take advantage of. With these four great investment spaces, making 2022 a great year for your personal finance can be simple.

1. Real estate still offers a great return.

Real property is one of the best investments you can make as a trader. The property market is on a long trending upward movement and shows no signs of changing course with any significant price action in the coming future. While there will always be fluctuations in this marketplace and in every other asset class, real estate provides a firm foundation for your nest egg like few other assets can.

With the example of a professional in this industry like David Lindahl, getting your start in real estate is actually much easier than you might think. David Lindahl has been a specialist in multifamily real estate deals for many years and his portfolio has included thousands of units at once. David Lindahl provides mentorship and advice to real estate investors in the form of podcasts, books, seminars, and boot camps. Taking in these mentor products is a great way to launch a brand new segment of your investment portfolio in the real estate space with little lead time.

2. Consider specialized companies in the stock market.

Companies that trade in the stock market, like Alamos Gold, offer a unique return on investment that can be hard to match with other corporate enterprises. Alamos Gold Inc. (NYSE:AGI) is a multinational gold mining company headquartered in Canada. With mines in Northern Ontario and Mexico (the Young-Davidson and Island Gold Mine, and Mulatos Mine in Sonora, respectively), Alamos Gold is an industry leader in North America and has a number of new projects in the works at home and abroad as well.

Alamos Gold leads the pack in their production rating in terms of hundreds of thousands of ounces of gold per year, but Alamos is also transforming the way gold miners think about environmental sustainability. With new and improving technologies, Alamos is shedding the old and detrimental ways of extracting ounces of gold from the earth.

3. Capitalize on the cryptocurrency marketplace.

Cryptocurrency is another asset class that many people are investing in with great results. Crypto offers a new digital asset that can double as both an investment commodity and a direct purchasing object for making consumer spending decisions. Crypto assets like Bitcoin and Ethereum are enjoying massive price spikes, so investing here could make the difference between a modest gain and a huge one that sets you up for a lifetime of success and comfort.

4. Gold bullion is a unique physical commodity with staying power.

Finally, bullion (gold or other precious metals) can provide you with incredible stability over the long term. Many people love the power of gold as a hedge against the stock market and other commodity assets because they often share an inverse price relationship. When the market begins to see a bear run coming into play, investors shift focus into hard currencies, gold assets, and bonds. By diversifying your portfolio and including these types of additional commodities, you can set yourself up to take advantage of future price appreciations.

Consider these asset classes this year for a more vibrant trading experience.